sales tax on leased cars in nj

New Jersey also has a use tax. Changes to the New Jersey Sales and Tax Use Law and changed the formula for calculating the tax on auto leases.

Nj Mvc Vehicles Exempt From Sales Tax

If you wish to claim exemptions other than the ones listed.

. Additionally effective January 1 2018 the New Jersey Sales and Use Tax. In addition to taxes car. For motor vehicle leases agreements for a term of more than 6 months entered into on or after 100105 the following is a summary of the items that are and are not included.

Britten440 January 18 2019 255am 3. Like with any purchase the rules on when and how much sales tax youll pay. All zero emission vehicles ZEVs sold rented or leased in New Jersey are exempt from state sales and use tax.

A new law reduced the New Jersey Sales and Use Tax rate from 7 to 6875 on January 1 2017. Sales tax is basically your total lease cost 6625. The law requires a reduction to 6625 on January 1 2018.

New Jersey will want to see proof the sales tax was paid. Sales tax is not collected at the agency for New Jersey dealers it said. There is a luxury tax in New Jersey of 04 for new cars.

Heres an explanation for. This exemption does not apply to partial ZEVs including hybrid. 29 2021 530 am.

The following states have sales tax rates of or less than 10. For vehicles that are being rented or leased see see taxation of leases and rentals. This tax except for on services or.

Sales tax is a part of buying and leasing cars in states that charge it. This page describes the taxability of. However if you did not pay sales tax at the time of purchase you will need to pay the sales tax based on.

While New Jerseys sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. If the luxury tax applies it is selling price before rebates 04. There are several vehicles exempt from sales tax in New Jersey.

To claim your exemptions you must visit a motor vehicle agency. Charge sales tax on a leased car I purchased. Hawaii is at 45 and North Carolina charges at least 3.

Any goods or services you purchase in NJ including obtaining a car lease is subject to the sales tax. New Jersey collects a 7 state sales tax rate on the purchase of all vehicles.

Jeep Grand Cherokee Lease Offers Golling Chrysler Dodge Jeep Ram Of Roseville

Kia Dealership Hackettstown Nj Used Cars Motion Kia

Virginia Sales Tax On Cars Everything You Need To Know

Tesla Lease Guide Prices Estimated Payments Faqs And More Electrek

Clinton Honda Spring Event In Clinton Nj Clinton Honda Dream Car Garage Spring Event

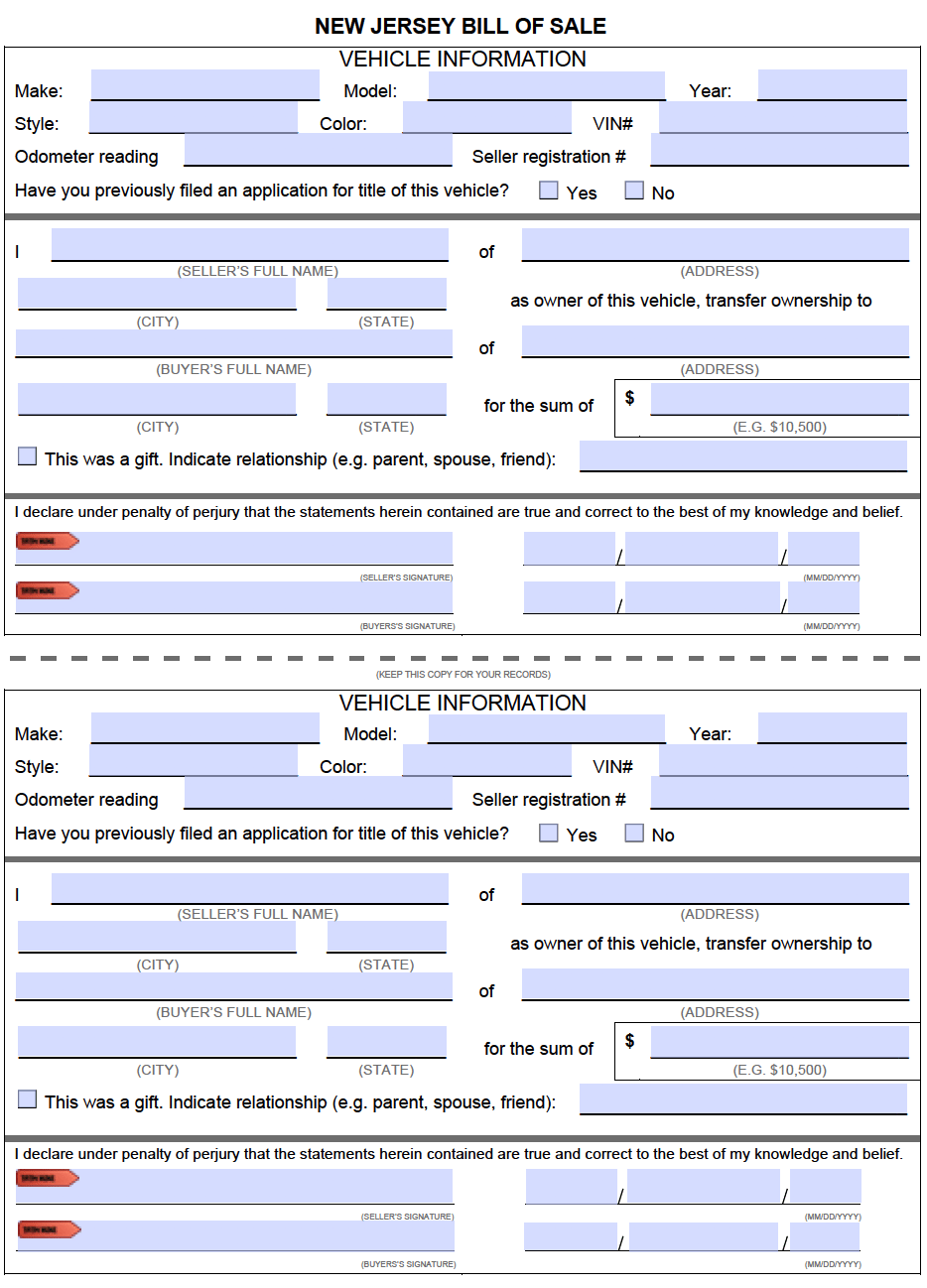

Free New Jersey Bill Of Sale Forms Pdf

Getting Lease Tax Money Back From Government Ask The Hackrs Forum Leasehackr

Used Cars For Sale In New Jersey Lester Glenn Auto Group Monmouth Ocean

Sales Taxes In The United States Wikipedia

Cadillac Dealer In Highland Mi Lafontaine Cadillac

New Jersey State Taxes 2021 Income And Sales Tax Rates Bankrate

95 97 Broad St Red Bank Nj 07701 Loopnet

Nj Auto Lending Red Bank Neptune Lakewood

New Genesis Hyundai Jeep Kia Dealer Ringwood Nj 07456 Lease Deals New And Used Cars Trucks And Suvs For Sale In Passaic County Global Auto Mall North Plainfield Nj